Are you buying a home for the first time? Do you think you will pay off half of the principal of a 30-year mortgage in 15 years? Are you wondering why banks want you to pay off interest before principal? If you answered ‘yes’ to any of these questions, you need to understand how amortization works before getting a mortgage.

How amortization works

The two most important points that you need to understand are:

- You only pay interest on the unpaid portion of the mortgage at any point during the entire amortization period.

- For the same interest rate and mortgage amount, you pay more money towards interest as the loan term increases.

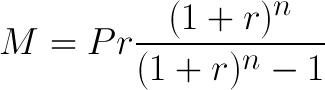

To illustrate this further, lets assume that you are planning to obtain a fixed rate mortgage (FRM) loan and intend to make monthly payments. Monthly payment on the loan is calculated as follows:

where

M is the monthly payment

P is the principal mortgage amount

r is the rate of interest calculated on monthly basis

n is the loan term, i.e., number of months

The monthly payment (M) remains fixed throughout the amortization period. Your monthly payment is used to pay the interest on the loan plus a part of the principal mortgage amount. Even though your monthly payment won’t change, the proportion of principal and interest components will vary with each payment. With each payment, you pay more in principal and less in interest.

Let’s consider an example where you borrow $12,000 at an annual interest rate of 5% for a period of 12 months. The monthly payment, calculated using the above formula, is $1,037.59.

| Month | Principal (A) | Interest (B) | Monthly Payment (A + B) | Balance | Loan Paid To Date |

| Jan | $977.29 | $50.00 | $1,027.29 | $11,022.71 | 8.14% |

| Feb | $981.36 | $45.93 | $1,027.29 | $10,041.35 | 16.32% |

| Mar | $985.45 | $41.84 | $1,027.29 | $9,055.90 | 24.53% |

| Apr | $989.56 | $37.73 | $1,027.29 | $8,066.34 | 32.78% |

| May | $993.68 | $33.61 | $1,027.29 | $7,072.66 | 41.06% |

| Jun | $997.82 | $29.47 | $1,027.29 | $6,074.84 | 49.38% |

| Jul | $1,001.98 | $25.31 | $1,027.29 | $5,072.86 | 57.73% |

| Aug | $1,006.15 | $21.14 | $1,027.29 | $4,066.71 | 66.11% |

| Sep | $1,010.35 | $16.94 | $1,027.29 | $3,056.36 | 74.53% |

| Oct | $1,014.55 | $12.73 | $1,027.29 | $2,041.81 | 82.98% |

| Nov | $1,018.78 | $8.51 | $1,027.29 | $1,023.03 | 91.47% |

| Dec | $1,023.03 | $4.26 | $1,027.29 | $0.00 | 100% |

As you can see from the above amortization table, the monthly payment remains the same during the entire 12 months. However, the principal component is increasing and interest component is decreasing with each successive payment. Also, the sum total of interest for the 12 months is $327.48 and not $600 (i.e., 5% of $12,000). Why so?

- In Jan, you would need to pay an interest of $50 (5% of $12,000 calculated on monthly basis). The remaining $977.29 ($1,037.59 – $50) goes to reduce the principal. The balance after the first payment is $11,022.71.

- In Feb, you need to pay an interest of $45.93 (5% of $11,022.71 calculated on monthly basis). The remaining $981.36 ($1,037.59 – $45.93) goes to reduce the principal. The balance after the second payment is $10,041.35.

- In Mar, you need to pay an interest of $41.84 (5% of $10,041.35 calculated on monthly basis). The remaining $985.45 ($1,037.59 – $41.84) goes to reduce the principal. The balance after the third payment is $9,055.90.

And so on, until the entire loan is completely paid off at the end of 12 months. You pay accrued interest on the outstanding principal balance each month. In addition, a portion of your monthly payment to reduce the principal. Otherwise you will be paying interest forever (as in the case of interest-only mortgage loans). In the beginning, the balance is large and so is the interest on it each month. As you keep paying more money towards the principal, the accrued interest decreases and the same monthly payment can now pay more towards principal. The amount that you pay towards principal increases with each successive payment.

| Mortgage Amount | Interest Rate | Loan Term (in months) | Monthly Payment | Loan paid off at midpoint | Total Interest Paid |

| $12,000 | 5 | 12 | $1,027.29 | 49.38% in 6 months | $327.48 |

| $12,000 | 5 | 360 | $64.42 | 32.12% in 15 years | $11,190.69 |

You have paid off only 49.38% (and not 50%) of the loan at midpoint (6 months). This percentage would be even lower for longer term loans. i.e., You pay more interest as the loan term increases.

Also, you will start off by paying more interest than principal as the loan term increases. For example, if you were to borrow the same $12,000 at the same annual interest rate of 5% for a period of 360 months (30 years), then your monthly payment will be $64.42. Your first payment will be $50 towards interest and only $14.42 towards principal. The interest component remains higher than principal for the first 192 months (16.17 years). It is no different even when you borrow $250,000 instead of $12,000. Again, you pay a lot more money towards interest as the loan term increases.

The sum total of all mortgage payments over the mortgage term minus the principal amount is the total interest amount you pay towards your mortgage.

total interest = (monthly mortgage payment X number of payments) – mortgage principal amount

Few strategies to pay less money to your lender

- Extra payments – As mentioned above, you pay less interest when the loan tenure is shorter. That doesn’t mean you sign a 15-year mortgage and struggle to make the monthly payments. Instead, its probably wiser to get a 30-year mortgage and make monthly payments along with extra payments towards the principal. This results in a shorter tenure and lower total interest amount.

- Accelerated bi-weekly payments – If you receive your paycheck once in 2 weeks, then you are better off making bi-weekly mortgage payments instead of monthly. Has a similar effect like that of extra payments.

- Purchase discount points – You can purchase discount points to reduce the interest rate (and the monthly payment) for the entire amortization period. You will need to stay beyond the break-even point to recoup the amount paid for discount points.

- Refinance – Switch to a lender that offers a comparatively lower interest rate. Ensure that the closing costs of the new loan don’t negate the benefits of a lower interest rate.