Mortgage points is a unique American approach to home financing. A mortgage point is an amount equivalent to 1% of the mortgage loan amount. For example, if you take a loan of $300,000, one point would be $3000.

There are two kinds of mortgage points: Origination points and Discount points.

Origination Points

Origination fee is charged by the lender to cover the costs of processing the loan. This fee is often expressed as a percentage of loan amount, aka mortgage points, instead of dollar amount. For example, if the origination fee is $1500 on a loan of $150,000, the lender will tell you that your mortgage comes with 1% origination fee OR one origination point.

Your credit history is one of the factors that determine how much origination fees you will need to pay. Origination points aren’t tax deductible.

But more often than not, when your broker or lender mentions mortgage points, he / she is referring to discount points. We will focus exclusively on discount points in the rest of this article.

Discount Points

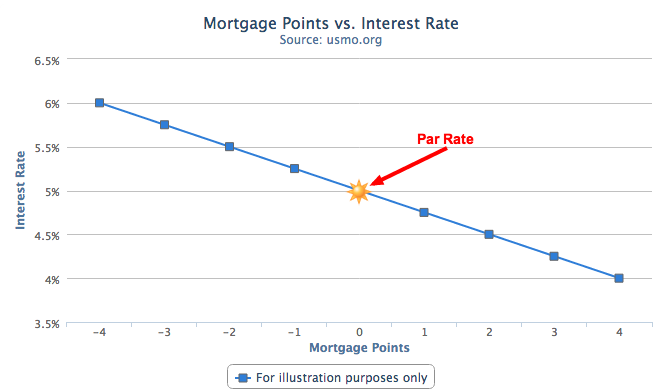

Discount points are a form of pre-paid interest that is paid, at closing, directly to the lender to reduce (or “buy down”) the interest rate on your mortgage loan. In short, the borrower obtains a lower monthly payment in return for this up-front payment. A mortgage point generally reduces the mortgage rate by one eighth (0.125%) to one-quarter (0.25%). The discount varies from one lender to another and fluctuates in response to changes in bond markets. Some lenders offer different interest rate plus mortgage points combinations on the same loan product. The mortgage rate at zero points is consider the lender’s ‘par rate’. Discount points are tax deductible.

Let’s consider example rates for 30-year fixed rate mortgage (FRM) from Lender XYZ:

| Rate | Points | APR |

| 3.875% | 1.524 | 4.075% |

| 4.000% | 0.461 | 4.111% |

| 4.125% | 0.000 | 4.197% |

The par rate for 30-year FRM is 4.125%. Assuming you plan to borrow $300,000 for your new home, your rate can be bought down to i) 3.875% by paying 1.524 points (i.e., $4572) & ii) 4% by paying 0.461 points ($1383) upfront to the lender.

Should you pay for discount points?

Paying for points provides a discount on the interest rate for the entire term of a fixed-rate mortgage. As a result your monthly payment is reduced and you pay less in interest towards your loan. To determine whether you should pay for points, its important to know how long you plan to keep the loan.

The break-even point is the time until when you need to keep the mortgage loan to recoup the amount that you’ve paid in fees. It is how long it takes for the fees paid to purchase points to equal the money saved by making smaller monthly payments on a lower-interest mortgage. The longer you stay beyond the break-even point, aka payback period, the more you benefit from paying for points. The break-even point is calculated as follows:

- Calculate the monthly mortgage payments for the ‘at-par’ interest rate and the discounted interest rate using our mortgage calculator or amortization calculator. (Ignore the taxes and insurance amount for this calculation).

- Calculate the difference in monthly payments to determine the amount saved each month.

- Divide the amount paid for points by the monthly savings amount to get the number of months you need to keep the mortgage to reach break-even point.

Let’s calculate the break-even point for the Lender XYZ example:

Loan Amount: $300,000

Mortgage Type: 30-Year Fixed Rate

| 0 Points | 0.461 Points | 1.524 Points | |

| Cost of points (A) | $0 | $1383 | $4572 |

| Interest rate | 4.125% | 4.000% | 3.875% |

| Monthly payment | $1454 | $1432 | $1411 |

| Reduction in monthly payment (B) | $0 | $22 | $43 |

| Break Even Point (A / B) | N/A | 62.86 months | 106.33 months |

| Total reduction in interest paid over 30-year tenure | $0 | $7,813 | $15,566 |

* All dollar amounts are rounded to their nearest full dollar amount for illustration purposes

* Taxes and insurance not included in the monthly payment

When not to pay for discount points

- Most Americans hold onto their mortgages for 7 years or less. You will not benefit (or benefit enough) if the break-even stage isn’t reached or the loan is held only for a few years beyond break-even point. If you plan to sell your home or refinance your mortgage before the break-even point, you shouldn’t pay points.

- Points for adjustable-rate mortgages (ARMs) typically reduce the interest rate on the loan’s initial fixed-rate period only. i.e., on a 5/1 ARM, the interest rate is reduced for the first 5-year period only and not for the adjustable period afterwards. Unless your home purchase is a very short term investment, paying points for ARMs isn’t recommended.

- Nowadays, points are aren’t worth what they used be. You may find better use for your cash if you are getting only a 0.125% discount instead of 0.25% for paying points. That money could be used for furnishing your new home instead. It doesn’t make financial sense to pay points and then use your high-rate credit card to pay for appliances and furniture.

- Purchasing points doesn’t make sense if the cash can be invested elsewhere for guaranteed higher returns.

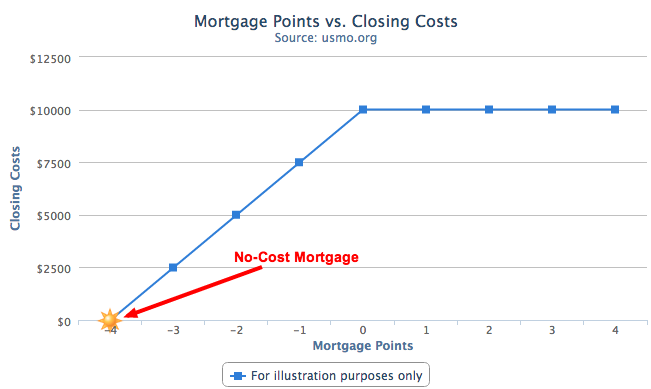

Negative Points

Negative points reflect the amount that will be credited to you by the lender and reduce the amount of closing costs you will pay. As a compensation, the lender increases the mortgage rate. For example, a lender might offer you a ‘no-cost mortgage’ in exchange for a higher mortgage rate. i.e., lender will offer pay all of your settlement costs, including broker’s fee but excluding pre-paid interest, taxes and insurance payments.

Discount Points Strategies

- If you fail to qualify for a loan due to higher monthly debt-to-income ratio, then purchasing points may help you qualify by reducing the mortgage interest rate.

- Both bigger down payments and purchasing points reduce your monthly payments in different ways. Larger down payments reduce your loan amount while discount points reduce the loan interest rate. If you plan to stay long term in the loan, then paying for points with your cash is usually advantageous compared to larger down payment. Make sure to include PMI and tax deduction on discount points when doing the math.

- You can save some cash by asking the seller to pay 3-6% of the sales price towards closing costs and use the saved cash to pay for points.

- Seller can offer to pay for discount points to help qualify more buyers. Buyers can claim tax deduction on the amount paid even if the seller pays for the points at closing.

- Negative points can be economical for short term investors and borrowers who intend to refinance within a short period of time. Negative points are also for borrowers who may not have the cash to close the deal. Negative points can almost be viewed as a tax planning strategy; higher interest mean higher interest deductible for your taxes. If the rates decrease, you can always refinance.

- When refinancing a mortgage, you may be able to roll the cost of points into the loan itself. Points can’t be rolled into the loan amount in a purchase loan.

The Bottom Line

Purchasing a home is a major financial decision. Decide on how much you can afford to pay every month for the next few years (or decades) and determine how you will get to that payment. If its acceptable, consider purchasing a less expensive home. From an overall financial and lifestyle perspective, ask yourself both the questions: Do I need this house? Can I afford the monthly payment?